Suck at money? Congrats. You’re part of the 99 percent of people in their 20s floundering when it comes to finance. Adulting is hard, and money is harder—especially when it’s your own and not your parents. My Two Cents is here to break down everything you need to know about finance, business, and entrepreneurship. We’ll tackle all the basics, from how to get a business permit to how to invest in stocks, to educate the fledgling adults on how to not go broke.

Welcome to the idiot’s guide to money. Fourth lesson: How to apply for a Social Security System (SSS) loan.

If you’re a law-abiding, tax-paying citizen, then you’ve been paying your SSS dues like most privately employed Filipinos. The SSS is the government’s social insurance program designed to assist citizens employed by private companies when things get rough—like in the case of medical emergencies, short periods of unemployment, or even house renovations. Most employees get their SSS ID numbers just before their first job, so this guide will cater to the individuals already equipped with an SSS number.

Think of it like the government’s personal loan program, and its members have to be tax-paying citizens.

More from EsquireMag.ph My Two Cents: How to Get a Business Permit

Who qualifies for an SSS loan? According to SSS , only the following are eligible for an SSS loan:

1| Employed, self-employed, or voluntary SSS members who are contributing their SSS payments

2| Must have paid a minimum of 36 monthly contributions (or a total of three years)

3| Must be updated in payment of contributions

4| Must be under 65 years old

5| Must not have been granted final benefits pertaining to total permanent disability, retirement, or death

6| Must not have committed fraud against SSS

Depending on the amount and the length of the loan you’re applying for, individuals applying for a one-month loan must have 36 months (three years) worth of posted contributions. Meanwhile, individuals interested in two-month loans must have at least 72 months (or six years) worth of posted contributions.

What if I’m not available to apply for an SSS loan? You can send a representative or your employer to apply for you. Just make sure they bring two valid IDs and a Letter of Authority. Overseas Filipino Workers can apply for SSS loans from the country they are based in, so long as the country has a Philippine SSS Foreign Representative Office.

More from EsquireMag.ph My Two Cents: How To Register Your Startup’s Business Name With DTI

How much can you borrow from SSS? A one-month salary loan is the average of your latest posted 12 monthly salary credits, and the maximum amount that can be loaned is P15,000. Meanwhile, two-month salary loans are twice the average with a maximum amount of P30,000.

The loan must be repaid at an interest of ten percent per annum based on the diminishing principal balance. Don’t panic at the ten percent interest—since the loan is a small amount, the interest will never exceed P300. A service fee of one percent will also be charged and deducted from the proceeds of the loan.

The amortization schedule of SSS loans is typically two years or 24 months. If you borrow P30,000, the amortization will cost you less than P1,500 per month for two years.

What do you need to apply for an SSS loan? You will need:

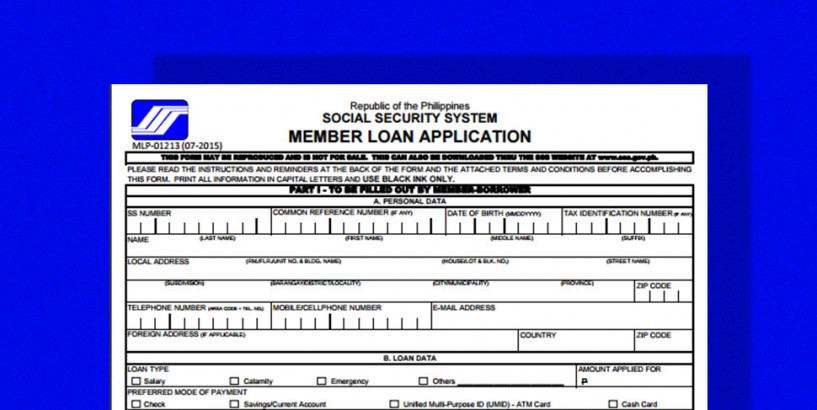

1| Member loan application form

2| SSS digitized ID or E-6 (the acknowledgement stub you get when you first apply for your SSS)

3| Any two valid IDs, preferably issued by the government and with a recent photo

More from EsquireMag.ph My Two Cents: BIR Registration for the Self-Employed

How to apply for an SSS loan? You only need to bring your requirements to the SSS branch nearest you. The SSS officer will assist you in processing your loan application.

You can also apply for a loan online via the online SSS Member Portal via the following steps:

1| Make sure you already have an account on the portal. If you’ve already registered, log in to your SSS portal, and on the main menu tab, under “Transaction,” click on “Salary Loan Application.”

2| Input the amount you intend to borrow, then click “Proceed.”

3| Under “View Loan Disclosure Statement,” verify that all the details presented are correct, then click “Submit.”

4| Wait for your loan to be processed and approved.

SSS loans take about two to three weeks to process starting from the date of application.

If you’re employed by a company (not self-employed), salary loans submitted online will be directed to your employer’s My.SSS account for verification.

You can view the schedule of repayment of loans here , which will largely depend on the last digit of your SSS number.

The question of “how to apply for an SSS loan” has become easier to answer thanks to a number of government agencies that have expanded their online services—and that’s something we’ll explore in another episode of My Two Cents.