By Kim Bo-eun

A growing number of private moneylenders are shutting down due to the government's tightening regulations on interest rates, according to industry sources. While the country's largest moneylender Sanwamoney declined to comment on its business, its website says it halted new loans in March this year.

The number two player in the sector Apro Financial, known by its brand Rush N Cash, and the number four player Welcom Creditline, known by its brand Welcome Loan, are set to close down their private moneylending business.

Apro took over OK Savings Bank and Welcome acquired Welcome savings bank in 2014. The Financial Services Commission (FSC) approved the deals on the condition that they shut down their private moneylending businesses by 2024.

Woncash and Miz Sarang owned by OK Savings Bank also shut down their businesses.

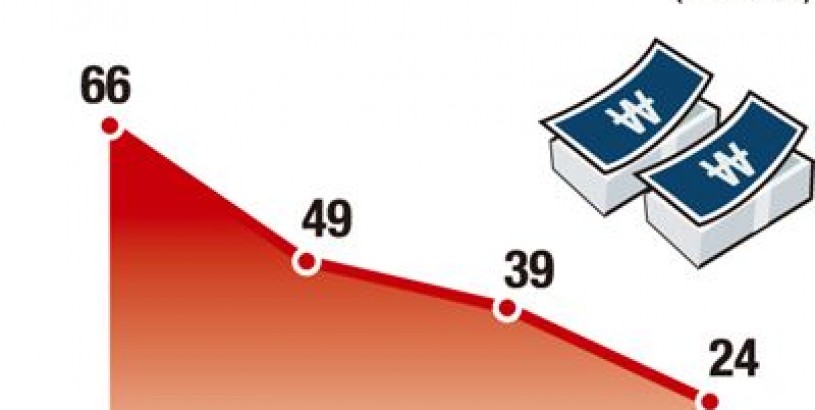

The moves come amid the government's continued lowering of the maximum interest rate. The rate has been lowered from 66 percent in 2002 to 24 percent last year.

The private moneylending business, unregulated, thrived in the late 1990s when the Asian Financial Crisis hit Korea. Interest rates reached several hundred percent. The government began regulating the sector in 2002.

Since 2015, private moneylenders with more than 10 billion won in assets have been required to register with the FSC instead of local governments.

Last year, the government lowered the maximum interest rate from 27.9 percent to 24 percent.

According to a survey by the Korea Research Institute for Financial Inclusion conducted on 250 private moneylenders last year, 24.7 percent halted new loans after the interest rate was lowered to 24 percent.

This is the last legal resort for low credit level holders that cannot get loans from banks.

With the majority of players exiting the sector, low credit level holders have fewer options, and may have to turn to illegal private lenders for the funds they need.

The average interest rate of illegal private lenders' loans exceeds 350 percent.

Businesses in the sector claim Korea's cap on the maximum interest rate is too stringent. Singapore has a maximum of 48 percent, and the average interest rate cap in the U.S. is 36 percent.

"Excessive regulation can lead to the growth of the black market," an official of the Korea Research Institute for Financial Inclusion said.

"This defeats the purpose of having legalized private moneylending," he said, noting using services offered in the black market exposes users to potential crimes.

bkim@koreatimes.co.kr